Sustainability

Sophisticate Corporate Governance

The RIKEN TECHNOS GROUP positions “Sophisticate corporate governance” as a key management issue. We will establish effective governance mechanisms across the Group and strive to ensure management transparency and fairness to achieve sustainable growth and improve corporate value over the medium- to-long term through the implementation of the “RIKEN TECHNOS WAY,” its management philosophy. At the same time, we will further advance dialogue with our shareholders and investors.

Indicators

Composition of Board of Directors

| Indicators | Unit | FY2021 | FY2022 | FY2023 | ||

|---|---|---|---|---|---|---|

| Director | Inside directors | Male | people | 6 | 5 | 5 |

| Female | people | 0 | 0 | 0 | ||

| Total | people | 6 | 5 | 5 | ||

| Independent outside director | Male | people | 3 | 3 | 3 | |

| Female | people | 0 | 1 | 1 | ||

| Total | people | 3 | 4 | 4 | ||

| Altogether | people | 9 | 9 | 9 | ||

| Ratio of independent outside director | % | 33.3 | 44.4 | 44.4 | ||

| Ratio of female directors | % | 0.0 | 11.1 | 11.1 | ||

Number of Major Meetings and Attendances

| Indicators | Unit | FY2021 | FY2022 | FY2023 | |

|---|---|---|---|---|---|

| Board of directors meeting | Number of meetings held | times | 17 | 16 | 16 |

| Average attendance ratio | % | 100 | 100 | 100 | |

| Audit & supervisory committee | Number of meetings held | times | 14 | 16 | 18 |

| Average attendance ratio | % | 100 | 100 | 100 | |

Corporate Governance Policy

RIKEN TECHNOS GROUP sets forth the basic policy for corporate governance, based on the purpose and spirit of the Corporate Governance Code. Detailed information is available on below PDF file.

RIKEN TECHNOS GROUP Corporate Governance Policy

Report on Corporate Governance

We submitted the report on Corporate Governance to Tokyo Stock Exchange. Detailed information is available on below PDF file.

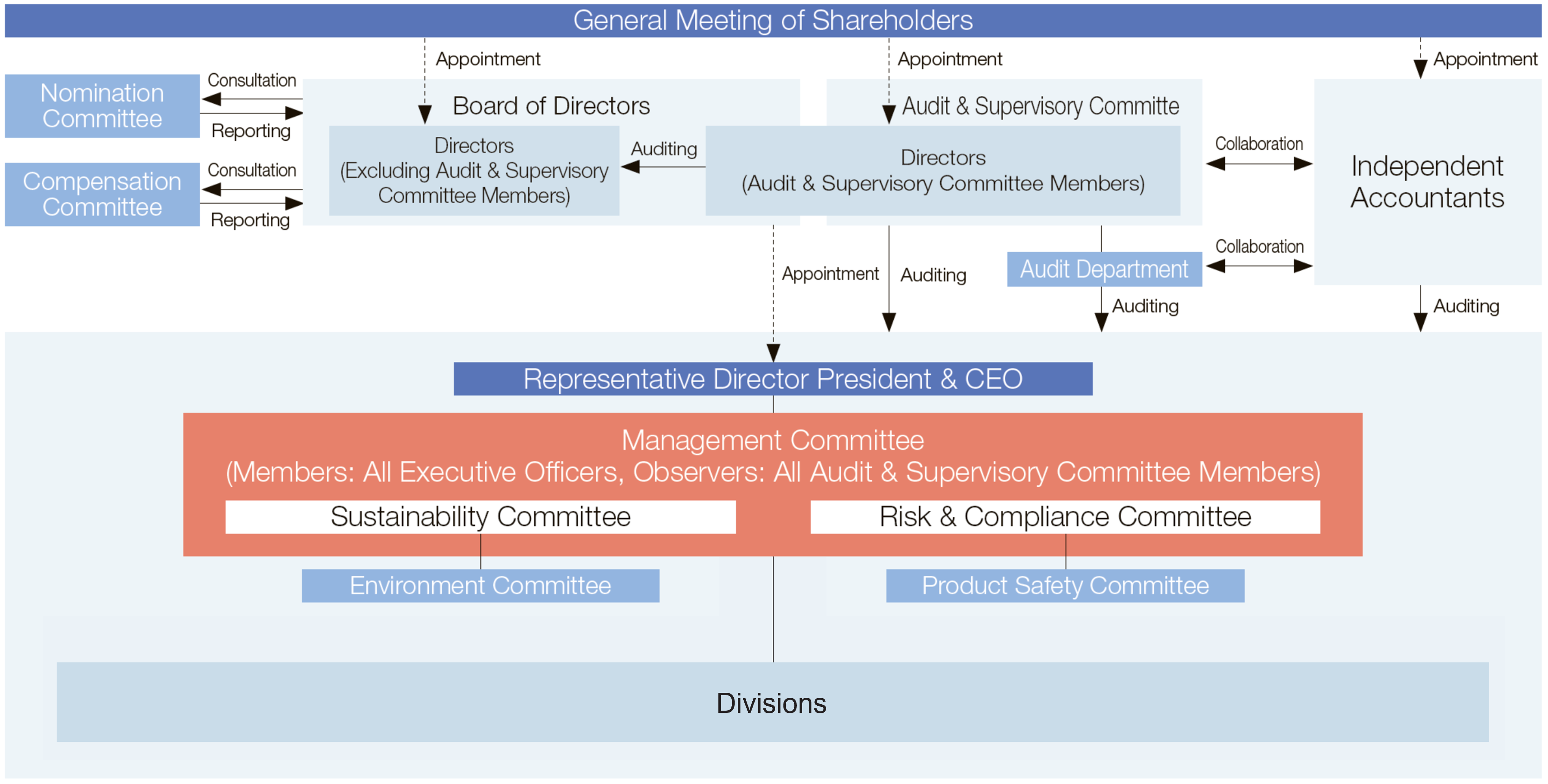

Corporate governance structure

Overview of Corporate Governance System

| Name of Meeting | Number of Meetings Held (FY2023) | Details |

|---|---|---|

| Board of Directors | 16 |

Members: Three Directors (excluding Directors who are Audit & Supervisory Committee Members), and four Directors who are Audit & Supervisory Committee Members To ensure management transparency and soundness, at least one third of the Directors are Independent Outside Directors. In addition, Directors are appointed so that the Board of Directors has the appropriate scale and composition taking into consideration factors such as the Board's overall balance in knowledge, experience, and capabilities; maintenance of diversity; and invigoration of deliberations.

[Major Matters Deliberated in FY2023] |

| Management Committee | 12 |

Members: All Executive Officers The Management Committee comprises all Executive Officers. Outside Directors also attend the meetings from the perspective of management supervision and state their opinions as necessary. In addition, meetings are held ahead of Board of Directors meetings each month to deliberate beforehand issues being put forth to the Board of Directors as well as to deliberate and decide on the execution of the important tasks for which authority has been delegated by the Board of Directors. |

| Sustainability Committee | 6 |

Members: All executive officers Sustainability Committee comprises all Executive Officers who are members of the Management Committee, with Outside Directors participating as observers. Led by senior management, we have established an organizational structure that enables expedited management decision-making and implementation of measures. The Sustainability Committee identifies and reviews key issues (materiality topics) to be undertaken with priority by the RIKEN TECHNOS GROUP in the area of sustainability, approves the response policies and targets for the identified key issues, and oversees and evaluates the progress of activities. It also promotes company-wide sustainability-related education and activities to spread sustainability. |

| Risk & Compliance Committee | 3 |

Members: All Executive Officers The Risk & Compliance Committee comprises all Executive Officers who are members of the Management Committee, with Outside Directors participating as observers. In principle, meetings are held once every six months, and the details of the committee’s activities are reported to the Board of Directors as appropriate. Besides listing, analyzing, and evaluating the Group’s overall risks, the committee understands critical risks, identifies risks to be handled with priority, and formulates countermeasures for those risks. In addition, the committee carries out comprehensive risk management for the Group as a whole, such as confirming the progress of risk countermeasures every six months, making revisions to them, and instructing the relevant departments to carry out improvements as necessary. |

| Audit & Supervisory Committee | 18 |

Members: Four Audit & Supervisory Committee members (of which three are Independent Outside Directors) More than half of the Audit & Supervisory Committee Members are Independent Outside Directors, and at least one member has considerable expertise related to finance and accounting. In addition, the Fulltime Audit & Supervisory Committee Member is appointed to carry out prompt information collection within the company and closely share information with Outside Directors. |

| Nomination Committee/ Compensation Committee |

each 3 |

Members: President & CEO, Senior Managing Executive Officer, and three Independent Outside Directors) Both committees seek to substantiate discussions by including multiple Inside Directors as members in

[Major Matters Deliberated in FY2023] |

| Board of Outside Directors | 3 |

Members: All Independent Outside Directors Independent Outside Directors take on the roles of providing active advice regarding management, supervision of management in general, and supervision regarding conflicts of interests as well as reflecting opinions of stakeholders at Board of Directors meetings. *The independence standard for outside directors is defined in the RIKEN TECHNOS GROUP Corporate Governance Policy. |

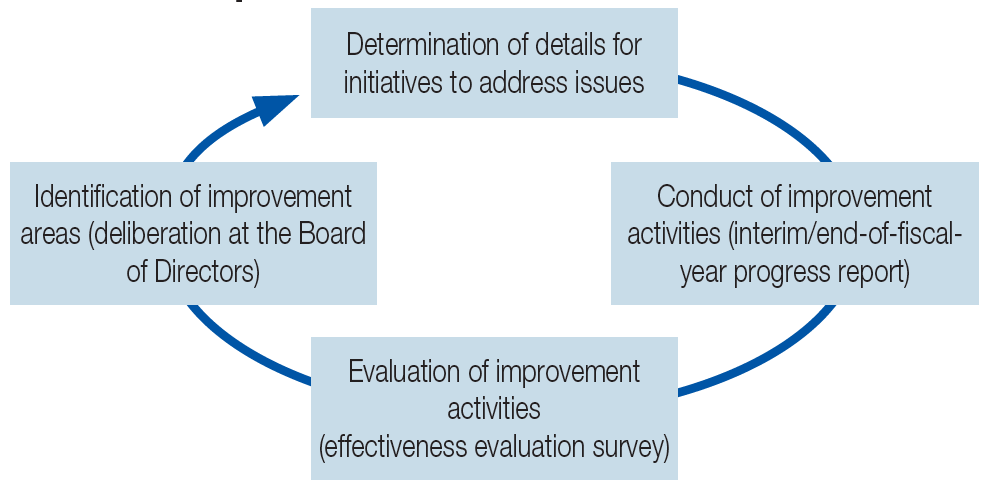

Effectiveness Evaluation of Board of Directors

To improve the functions of our Board of Directors, we conduct evaluation and analysis of its effectiveness each year.

Key points of evaluation for FY 2023

1. Advancement of internal control and company-wide risk management

2. Relationships with shareholders and investors

3. Promotion of initiatives to address sustainability issues

Issues and initiatives for FY2023 (actual)

| Issues for FY2023 | Actual initiatives for FY2023 |

|---|---|

| Enhancing the Effectiveness of Group Control |

Officers, including the Representative Director, visited consolidated subsidiaries in Japan and overseas to grasp the actual situation of each company and provide direct guidance to strengthen the Group’s control. In addition, through the holding of information-sharing meetings for consolidated subsidiaries and briefing sessions on the progress of the Medium-term Business Plan for overseas subsidiaries, issues were identified and shared between the Company’s management and the management of consolidated subsidiaries. |

| Enhancing dialogue with shareholders and investors |

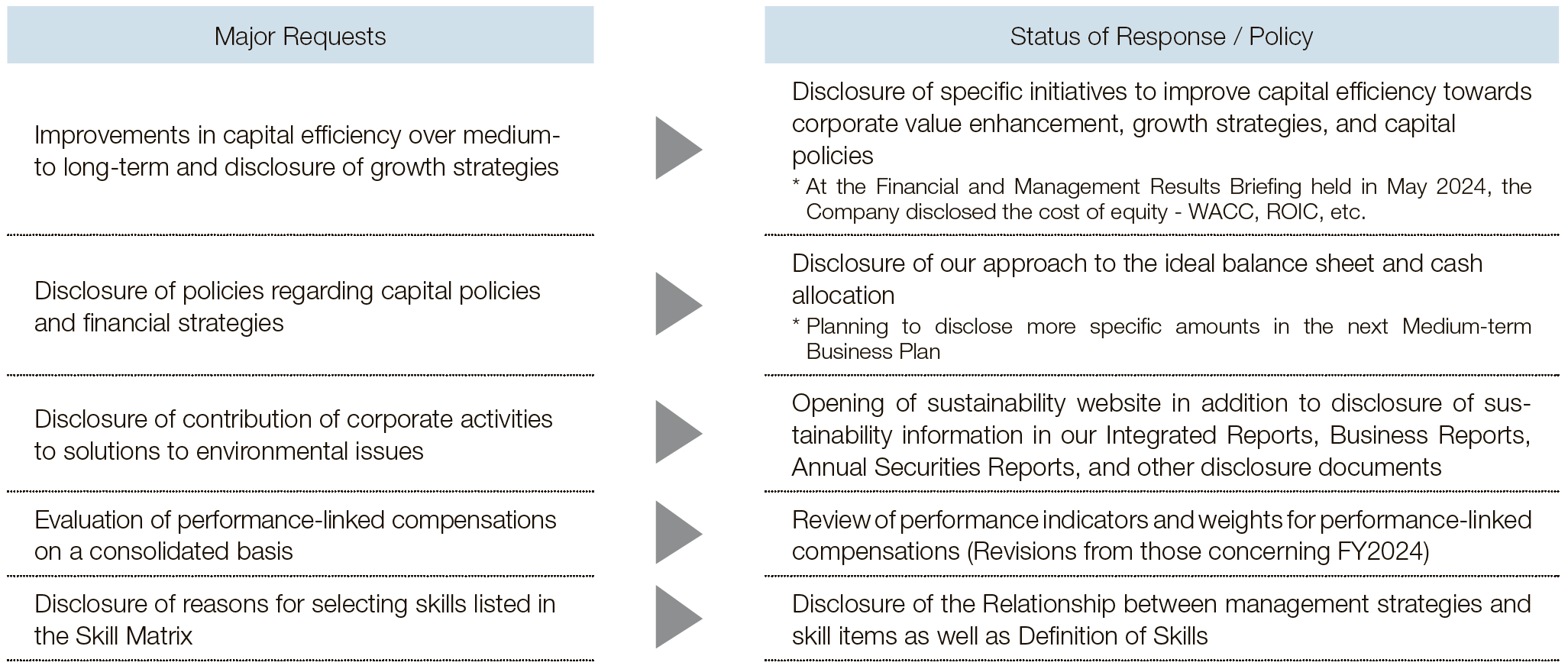

We expanded our financial and non-financial disclosure by publishing the Integrated Report, incorporating sustainability information into the Annual Securities Report, and disclosing measures to achieve management with an emphasis on stock prices and capital costs. In addition, approaches have been advanced for constructive dialogue with shareholders and investors. The opinions of investors obtained in the SR meeting were reported and deliberated at the Management Committee and the Board of Directors, and then reflected in various measures. |

| Addressing Sustainability Issues |

As guidelines for human capital and human rights initiatives, we formulated the Human Resource Development Policy, the Internal Environment Development Policy, and the Human Rights Policy. In addition, we appropriately supervised efforts to address issues related to sustainability by receiving reports on the progress of KPIs for materiality from the Sustainability Committee. |

Issues and initiatives for FY2024 (planned)

| Issues for FY2024 | Planned initiatives for FY2024 |

|---|---|

| Dialogue with shareholders and investors |

We will continuously review the disclosure content and discuss initiatives to further promote constructive dialogue, including disclosure of new information from both financial and non-financial aspects. In addition, we will continue to appropriately reflect opinions obtained through dialogue in our internal structure. |

| Promotion of huma capital management |

We will pursue discussions in conjunction with our management strategy, with an eye toward the next Medium-term Business Plan. |

| The restructuring of the business portfolio |

Discussions will be promoted, including a review of low-profit businesses, while the allocation of management resources will be supervised from a medium- to long- term perspective. |

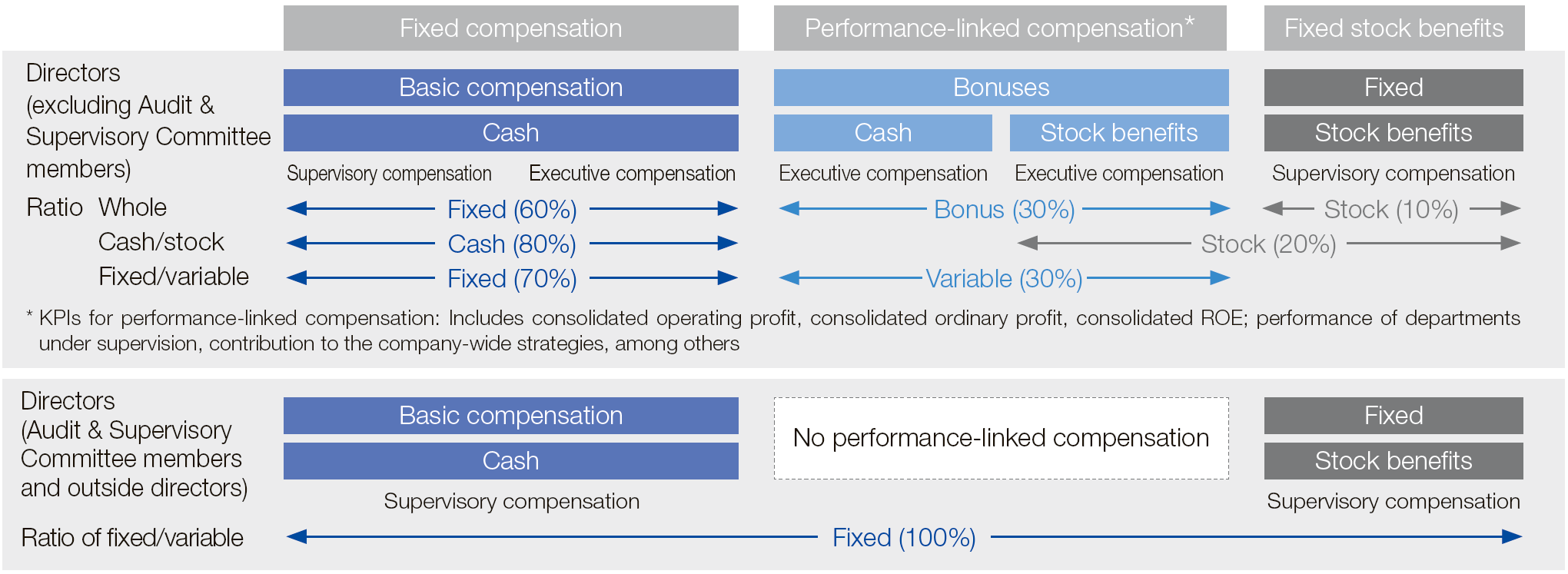

Compensation of Directors

Basic Policy

The compensation of directors (excluding directors who are Audit & Supervisory Committee members) serves as motivation for improving the performance of each fiscal year and improving the corporate value over the medium to long term. In addition, as a compensation system that allows value to be shared with shareholders, the appropriate level of compensation is set according to position and responsibility. To ensure objectivity and transparency when determining these levels, respect is shown to the opinions of the Compensation Committee, where more than half of the members are independent outside directors.

Composition of Director Compensation

Compensation for Directors (excluding Directors who are Audit & Supervisory Committee Members) consists of executive compensation and supervisory compensation. Executive compensation consists of a fixed amount of basic compensation (cash) and bonuses as performance-linked compensation (cash and stock benefits). Supervisory compensation consists of a fixed amount of basic compensation (cash) and a fixed amount of stock benefits.

The compensation of directors who are Audit & Supervisory Committee members comprises only fixed compensation not linked to performance (basic compensation) and fixed allocation of shares.

Policy for Reducing and Repaying the Amount of Compensation (malus and clawback provision)

If there is a material error in the financial statements or a material accounting irregularity, or if Directors (excluding Directors serving as Audit & Supervisory Committee Members) violate laws, regulations, or the Articles of Incorporation, etc., the Company shall be able to demand a reduction of the amount of compensation or the repayment of compensation paid.

The specific amount of the reduction or repayment demanded shall be determined by the Board of Directors after consulting with the Compensation Committee, with respect for the results of such reports.

Process for the Determination of Director Compensation

In deciding the amount of compensation for directors (excluding directors who are Audit & Supervisory Committee members), the Board of Director first consults the Compensation Committee where more than half of the members are independent outside directors. The decision is then made giving due respect to the reply from the committee.

The compensation of directors who are Audit & Supervisory Committee members is decided through deliberation by the directors who are Audit & Supervisory Committee members, within the amount established through resolution at the General Meeting of Shareholders.

Director Compensation System

Total Amount of Compensation, etc. for FY2023

| Director classification | Total amount ofcompensation, etc. (Thousands of yen) | Total amount by type of compensation, etc. (Thousands of yen) | Number of applicable directors | |||

|---|---|---|---|---|---|---|

| Fixed compensation | Performance-linked compensation (Bonuses) | Fixed stock benefits | ||||

| Basic compensation | Cash | Stock benefits | ||||

| Directors who are not Audit & Supervisory Committee members (excluding outside directors) | 198,488 | 116,219 | 51,789 | 15,318 | 15,161 | 4 |

| Directors who are Audit & Supervisory Committee members (excluding outside directors) | 17,691 | 16,200 | - | - | 1,491 | 1 |

| Outside directors (Audit & Supervisory Committee members) | 39,313 | 36,000 | - | - | 3,313 | 4 | Total | 255,492 | 168,419 | 51,789 | 15,318 | 19,966 | 9 |

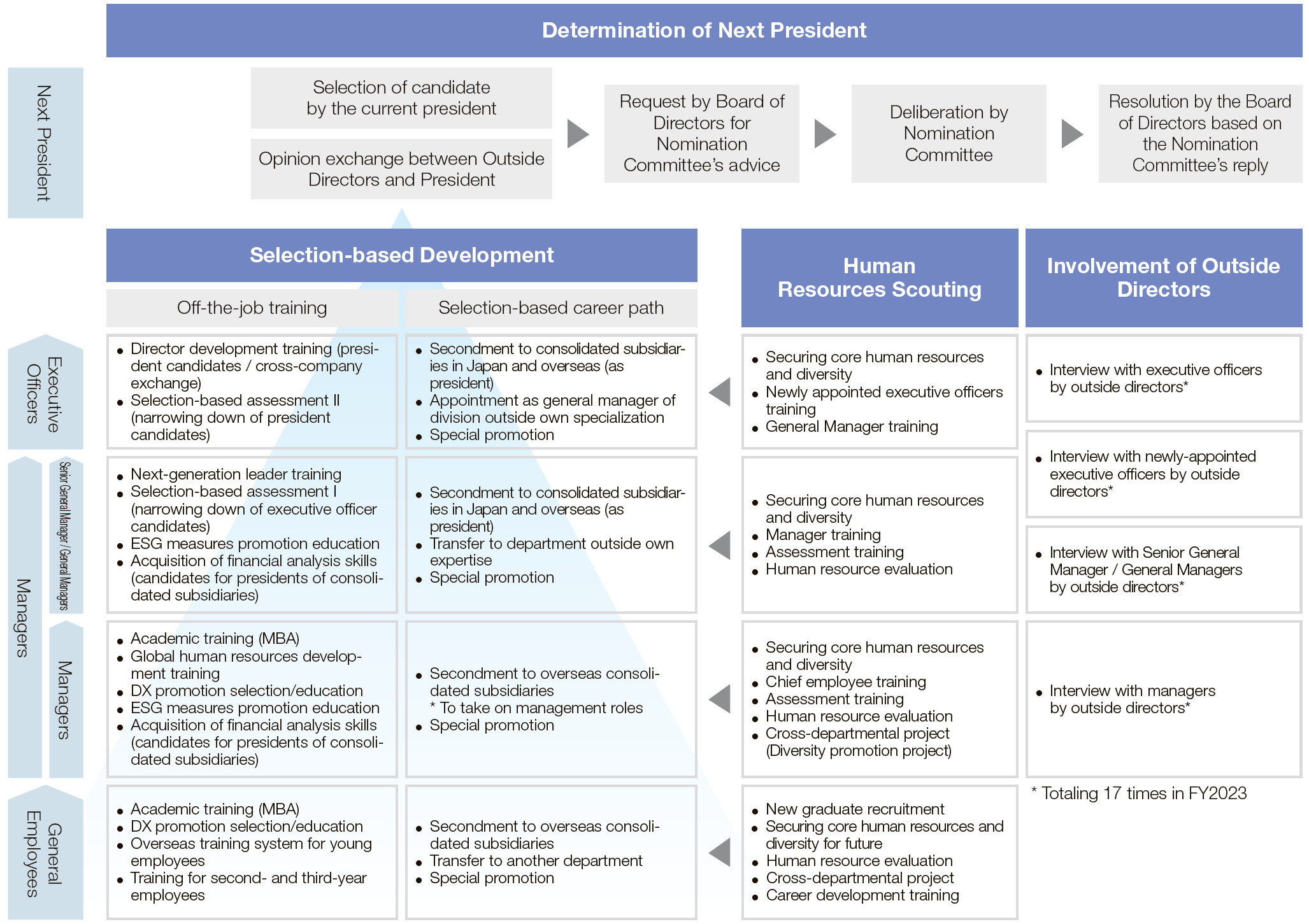

Succession Plan

We formulate our succession plan to secure a pool of human resources for the group of management candidates. Taking into consideration our corporate philosophy, management policy, and other factors, so that the development of management candidates is carried out systematically with adequate time and resources, the Board of Directors and the Nomination Committee will continue to take the initiative to intervene in the plan’s implementation and carry out regular supervision.

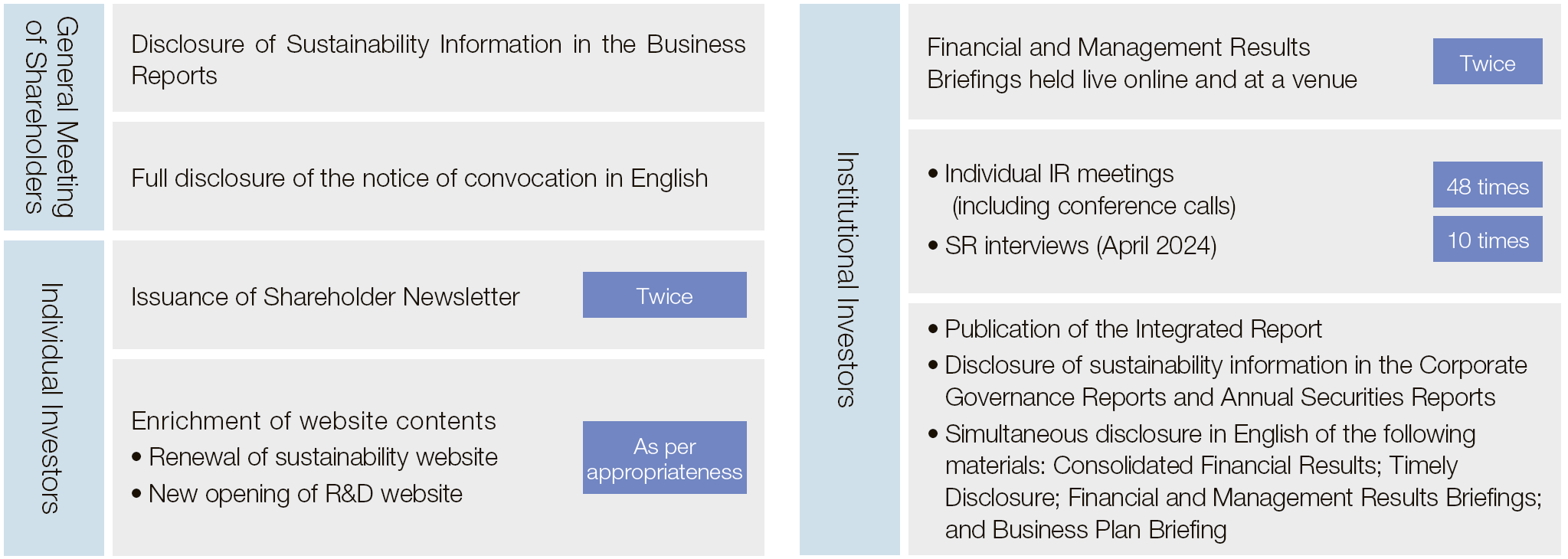

Dialogue with Shareholders and Investors

The Company takes a variety of initiatives, including Financial and Management Results Briefings and individual interviews for

institutional investors so that constructive dialogue can be established with shareholders and investors.

Policy concerning Dialogue with Shareholders (Summary)

● Executive Officer in charge of corporate planning supervises all matters related to shareholder dialogue.

● The Company’s basic approach to dialogue with shareholders is to make senior management, including the President and related Executive Officers, and Directors, including Outside Directors, attend dialogue with shareholders and engage in direct dialogue with shareholders, to the extent reasonable. In addition, the Company will establish a system to enable it to accurately address the wishes of shareholders and the main matters of interest in interviews, through the appointment of a primary Independent Outside Director.

● The opinions of shareholders obtained through dialogue will be reported to the Board of Directors, the Management Committee, etc., as appropriate, and information will be shared and utilized by related divisions.

Dialogue in FY2023 (Actual)

Status of Feedback

Opinions obtained through dialogue with shareholders and investors are reported as appropriate at the Management Committee and the Board of Directors meetings, and such information is shared among the relevant departments and incorporated appropriately and effectively into corporate activities. We will continue to actively engage in dialogue with shareholders and investors while focusing on the above initiatives to further enhance our corporate value.

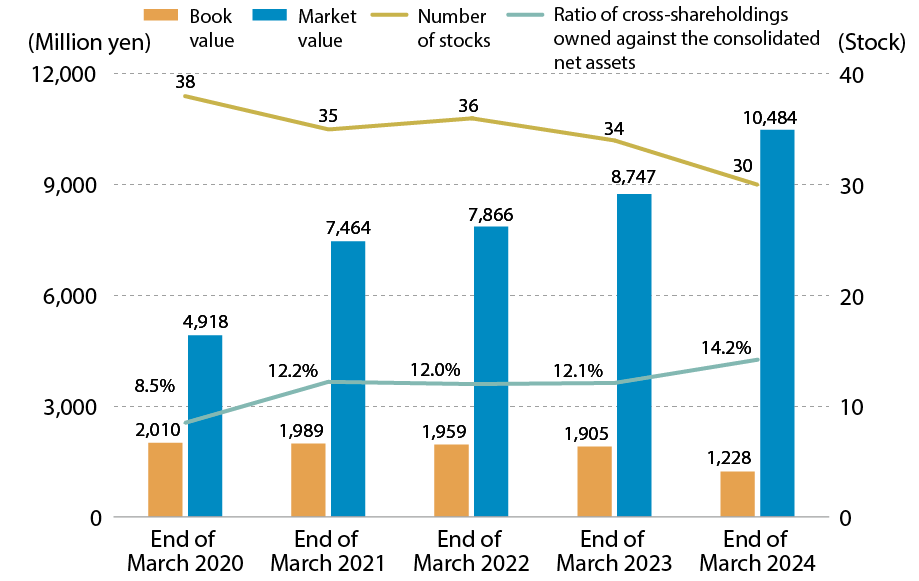

Strategic Holding of Shares

With regard to strategic-holding shares, the Company shall ensure that the Board of Directors annually review specifically the rationality of holding each company’s stocks including the cost of equity and the benefits of holding, and immediately reduce the ratio of strategic-holding shares to reach less than 10% of consolidated net assets. The cash generated by the reduction will be used primarily for growth investment and also for shareholder returns, and in this way we will accelerate medium to long term growth in the future.

In FY2023, in addition to examining the appropriateness of holding individual stocks, including those held by consolidated subsidiaries, we conducted comprehensive examinations, including capital policies, and sold all or some of 24 of the 34 issues (stocks) held by the Company. All proceeds from the sale were used to fund the acquisition of treasury stock.