Sustainability

Responding to Climate Change

Tighter greenhouse gas (CO2) emission regulations aimed at realizing a decarbonized society and an increase in natural disasters due to climate change may pose a risk for the Group’s overall financial condition. At the same time, by developing products acceptable to a decarbonized society, this situation can also lead to business opportunities.

To that end, The RIKEN TECHNOS GROUP has set GROUP-wide goal of carbon neutrality by 2050, and is striving to introduce renewable energy and promote energy conservation in order to alleviate climate change. In addition, in order to adapt to climate change, we have formulated a BCP and established a system to minimize damage and loss.

Our Group has also announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and we undertake initiatives and information disclosure in line with the recommendations.

Task Force on Climate-related Financial Disclosures (TCFD)

This is an industry-led task force established in 2015 by the Financial Stability Board (FSB) in response to G20’s intention. The task force recommends the evaluation of financial impact of risks and opportunities arising from climate change on management and disclosure in four thematic areas (governance, strategy, risk management, and metrics and targets) (Official website of TCFD: https://www.fsb-tcfd.org/)

Indicators and Targets

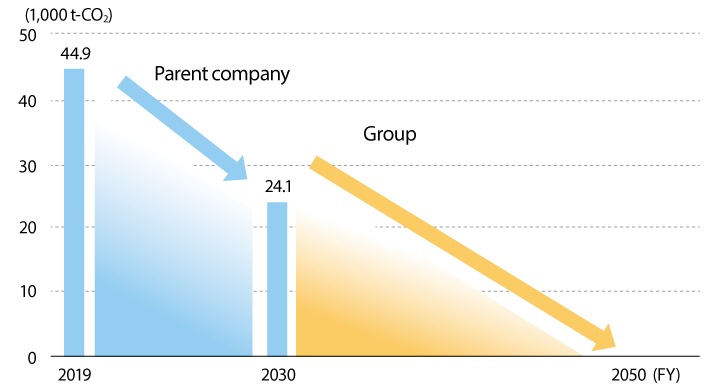

The RIKEN TECHNOS GROUP seeks to achieve carbon neutrality for the entire Group by 2050. In addition to setting medium- to long-term emissions reduction targets for the Group as a whole, we are planning specific initiatives to cut CO2 emissions and have determined indicators to manage the progress of these initiatives.

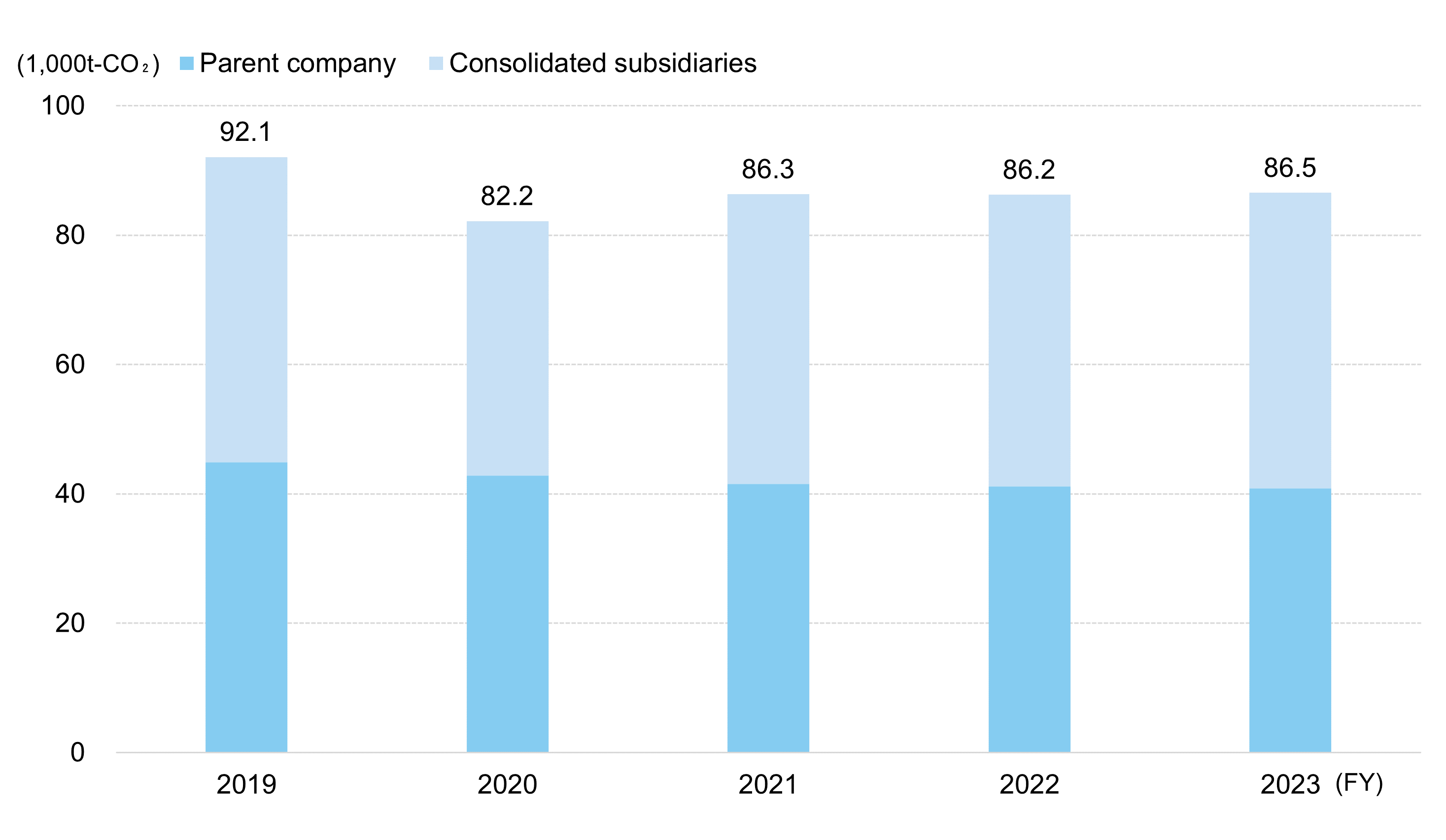

| Indicators | Scope | Unit | FY2022 | FY2023 | FY2024 | Medium- to Long-term Targets | |

|---|---|---|---|---|---|---|---|

| FY2027 | FY2030 | ||||||

| CO2 emissions (Scope 1 and 2) | non-consolidated | t-CO2 | 41,139 | 40,859 | 38,017 | 29,792 | 24,139 (46.2% decrease compared to FY2019) |

| consolidated | t-CO2 | 86,220 | 86,520 | 79,539 | - | - | |

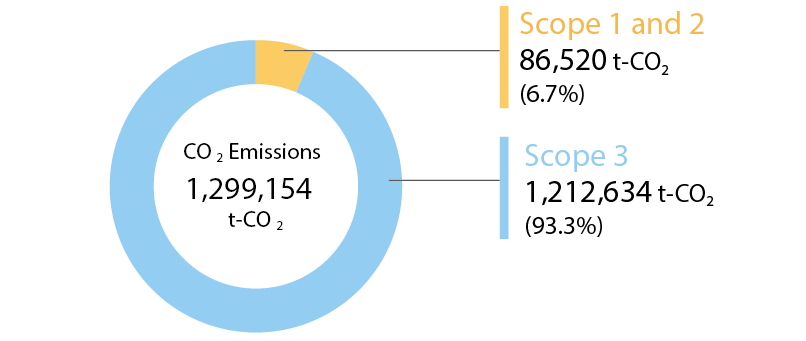

Our Group’s CO₂ Emissions (FY2023)

| Category No. | Category Name | Emissions(t-CO2) |

|---|---|---|

| 1 | Purchased goods and services | 956,765 |

| 2 | Capital goods | 13,750 |

| 3 | Energy not Included in Scope 1 or Scope 2 | 10,033 |

| 4 | Upstream transportation and distribution* | 989 |

| 5 | Waste generated in operation | 690 |

| 6 | Business travel | 248 |

| 7 | Employee communiting | 872 |

| 9 | Downstream transportation and distribution* | 5,141 |

| 12 | End-of-life treatment of sold products | 215,146 |

*Category 4 and 9 emissions concerm RIKEN TECHNOS CORPORATION only.

The Sustainability Committee

The following climate-related topics are deliberated by the Sustainability Committee.

Main topics deliberated by the Sustainability Committee

- Climate-related scenario analysis

- Identification and materiality assessment of short-, medium-, and long-term climate-related risks and opportunities

- Strategic approach policy for identified significant climate-related risks and opportunities

- Consideration of specific measures for responding to climate-related risks and opportunities

- Management of progress with adopted measures for responding to climate-related risks and opportunities

Sustainability Promotion Structure

Scenario Analyses

The Group has performed scenario analyses for the years 2030 and 2050 in the context of climate change based on two world views: a 1.5℃ and a 4℃ rise in global temperatures by 2100. In our analysis, we refer to the scenarios disclosed by the government bodies and research institutes listed in the table below:

| World View | Scenarios Used in the Analysis |

|---|---|

| 1.5℃ | World Energy Outlook (WEO), IEA, 2023 |

| Net Zero Emissions by 2050 (NZE) | |

| Shared Socio-economic Pathway (SSP1-1.9), IPCC, 2021 | |

| 4℃ | Stated Policy Scenario (STEPS), IEA, 2020 |

| Representative Concentration Pathways (RCP6.0, 8.5), IPCC, 2014 |

In the scenario with a 1.5℃ rise in global temperatures, which is a risk that is expected to have major financial impact, the introduction of a carbon tax will result in a shift from conventional raw materials to low-carbon raw materials, which is expected to generate or increase costs associated with the development and procurement costs of substitute raw materials. In the scenario with a 4℃ rise in global temperatures, possibilities expected include an increase in the procurement cost of raw materials caused by soaring prices of petroleum-derived raw materials, the need for facility renewal expenditures to comply with environmental regulations, and higher costs of petroleum- and coal-derived raw materials and fuel.

Centered on the Sustainability Committee, we are identifying the short-, medium-, and long-term climate-related risks and opportunities while referencing the results of scenario analyses and evaluating their criticality and financial impact. At the same time, we are studying specific measures for the identified risks and opportunities and managing the progress of our initiatives.

Risks

The Group's performance may be affected by the introduction of policy measures to combat climate change, such as a carbon tax, or by delays in the development of or other action concerning environmentally friendly products.

| Risk Type | Risk Overview | Financial Impact | Impact Term | ||

|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||

| Transition risk | Policies and regulations | Increased carbon taxes raise the cost of procuring key raw materials and energy. | Medium | Small | Long-term |

| Policies and regulations | The introduction of a carbon tax results in the substitution of conventional raw materials for low-carbon raw materials, which generates or increases costs associated with the development and procurement costs of substitute raw materials. | Large | - | Medium-term | |

| Technology | Delay in developing environmentally friendly products; our customers replace our products with low-carbon products from competitors, reducing demand for and sales of our products and services. | Medium | - | Medium-term | |

| Markets | Prices of petrochemical feedstocks soar, raising the cost of procuring raw materials. | Small | Large | Long-term | |

| Markets | Delay in responding to our customers’ reduced needs for petroleum-derived raw materials and rising needs for non-petroleum-derived raw materials, shifting demand away from our products/services and decreasing our sales. | Medium | - | Medium-term | |

| Reputation | Delayed action on the environment causes a drop in our stock price due to a decline in investors' assessment of our environmental performance. | Medium | - | Medium-term | |

| Physical risk | Acute | The Company and its supply chain are struck by a disaster; until operations are restored, sales decrease due to the suspension or reduction of business activities, while costs associated with restoration and amelioration rise. | Medium | Medium | Medium-term |

| Chronic | The cost of countermeasures for our buildings located near oceans and rivers will increase due to the increased occurrence of flooding caused by overflowing rivers and rising sea levels attributable to extreme fluctuations in rainfall and weather pattern. | Small | Medium | Short-term | |

Opportunities

The Group’s performance may be affected by the development of products that contribute to energy conservation and the provision of low-carbon type products and materials with added functions.

| Opportunity Type | Opportunity Overview | Financial Impact | Impact Term | |

|---|---|---|---|---|

| 1.5℃ | 4℃ | |||

| Energy sources | Development of products that contribute to energy conservation in the market and the uptake of renewable energy generation technologies and equipment increase sales of our related products. | Small | - | Short-term |

| Products and services | Demand for and sales of our products increase due to the development and sale of materials with additional functions and products with fewer petroleum-derived components (low-carbon type products) in response to increased demand for low-carbon type products. | Medium | - | Medium-term |

| Reputation | Proactive efforts to address climate change earn the trust of stakeholders and enhance our enterprise value. | Medium | - | Short-term |

| Resilience | The global expansion of our business sites improves our resilience by providing a stable supply of products to our customers even in an environment of increasing natural disasters, forestalling sales declines and building customer trust, leading in turn to higher sales. | Small | Small | Short-term |

Carbon Neutrality Initiatives

In addition to developing and enriching our environmentally friendly products such as the RIKEBIO® series, we are working on renewals of factory lighting and manufacturing-related facilities to those with less energy consumption, the introduction of EV forklifts, and the use of fuel-efficient vehicles.

Formulation of Energy Road Map toward the Achievement of CO₂ Emissions Reduction Targets

Following the Energy Road Map for RIKEN TECHNOS CORPORATION, we have been working on the formulation and implementation of measures to reduce CO₂ emissions.

We refer to the internal carbon pricing system introduced in FY2023 for capital investments expected to reduce CO₂ emissions in making our investment decisions to promote emissions reduction further.

We also determined to introduce solar power generation systems to factory buildings of a consolidated subsidiary in Thailand as an investment in the renewable energy field.

Future Initiatives

- Refining of the Energy Road Map

- Boiler energy conversion

- Introduction of additional solar power generation facilities

- Upgrades of equipment at production sites and energy conservation of existing equipment

- Expansion and increased sales of environmentally friendly products

Adaption to Climate Change

Business Continuity Plan and Business Continuity Plan and Response to Emergency Situations