News

2025/03/24

“One Vision, New Stage 2027” New Three-year Medium-term Business Plan Fiscal Year 2025 (Ending March 2026) – Fiscal Year 2027 (Ending March 2028) and Revision of Long-term Vision/Materiality Topics

RIKEN TECHNOS CORPORATION (Head Office: Chiyoda-ku, Tokyo; Representative Director, President & CEO: Kazuaki Tokiwa) hereby announces that at a meeting of the Board of Directors held on March 24, 2025, the Company resolved to adopt “One Vision, New Stage 2027,” its new three-year medium-term business plan for the fiscal years 2025 (ending March 2026) to 2027 (ending March 2028), and to revise its long-term vision and materiality topics.

1. Management Policy of the New Three-year Medium-term Business Plan

The management policy for the new three-year medium-term business plan will be “One Vision, New Stage 2027.”

This policy indicates our intention to change stages and aim for even greater heights, with a global long-term vision shared throughout the Company and the ideal image we want to achieve in next ten years, which has been newly added to the long-term vision.

2. Management Indicators

The consolidated target figures for the final fiscal year (ending March 2028) are as follows:

Net sales: 150 billion yen, Operating profit: 12 billion yen, Ordinary profit: 12 billion yen, Net profit: 6.5 billion yen

ROS: 8%, ROE: 10%, ROIC: 11%, EBITDA: 17 billion yen

3. Strategies/Measures

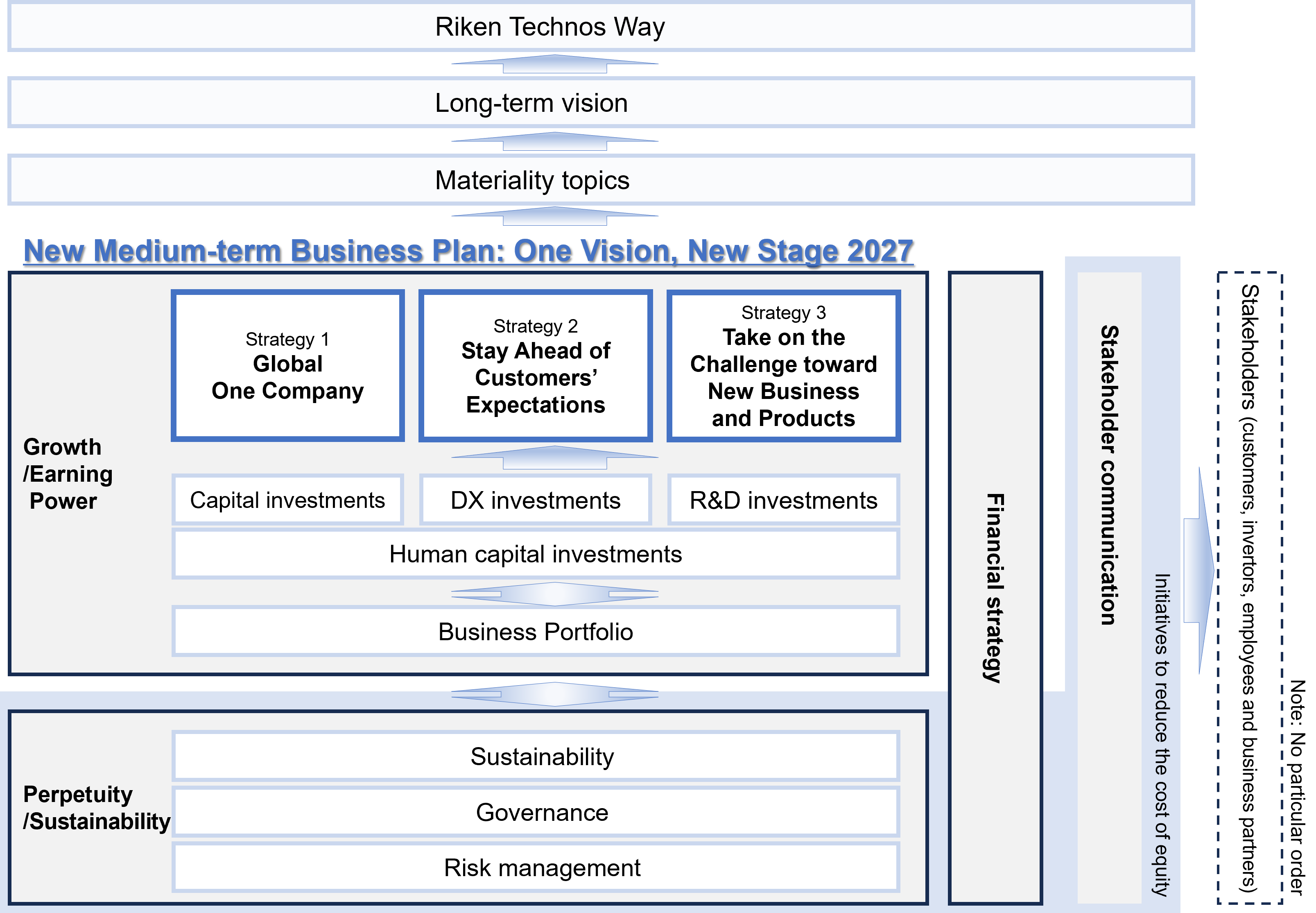

In the new three-year medium-term business plan, we will focus on the two main pillars of enhancing our “Earning Power” and “Sustainability,” while also working on financial strategies and stakeholder communication.

Earning Power: Three strategies

- Global One Company

- Stay Ahead of Customers’ Expectations

- Take on the Challenge Toward New Businesses and Products

(1) Global One Company

Building on the “Intensified Global Management and Synergies” we drove in our previous three-year medium-term business plan, we aim to elevate ourselves further and operate as a globally unified “Global One Company.” While our focus on ASEAN remains unchanged, we will also prioritize growth investments within Japan.

We will also focus on expanding business with non-Japanese companies as well as Japanese companies in the global market.

(2) Stay Ahead of Customers’ Expectations

We will continue to advance the strategy we laid out in our previous three-year medium-term business plan. To “Stay Ahead of Customer Expectations,” we will further our understanding of markets beyond our customers, enhance our information gathering and analysis capabilities, and, most importantly, invest in the development of personnel, all to enable us to provide better and more optimal proposals.

To ensure integrated, optimal, and prompt proposals from our technology, manufacturing, quality control, and procurement divisions, we will establish a new Monozukuri Headquarters. Under this new organization, we will work together as one to quickly propose and provide optimal products for our customers.

We will also focus on investments in MI and DX to support these efforts.

(3) Take on the Challenge toward New Businesses and Products

We will further advance the industry-academia collaboration initiatives that we promoted in the previous three-year medium-term business plan and launch new businesses from these initiatives during the new three-year medium-term business plan.

Under the newly established Monozukuri Headquarters, we will focus even more on developing new products demanded by the market and increase the proportion of new products in our business portfolio.

Investment and shareholder return

We will make investments to support this growth in Earning Power.

In addition to fundamental investments, we will focus on “growth investments” such as capacity expansion, labor saving, and manpower saving, as well as “strategic investments” such as inorganic growth, new business initiatives, and climate change responses.

We will also focus on research and development investments, along with capital investment and DX investments. In addition to advancing measures related to human capital investment, we will particularly focus on improving employee engagement.

Regarding shareholder returns, we will continue to maintain our current dividend policy of “to ensure a steady stream of dividends while considering future business investment, enhancement of shareholders’ equity, and other factors, with an aim at a consolidated dividend payout ratio of about 35%.” Furthermore, with a basic policy of not holding excessive equity, we will strive for further shareholder returns.

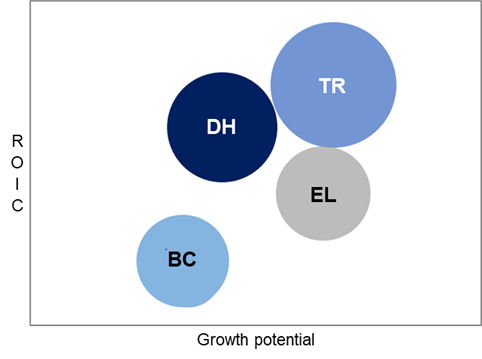

Business portfolio

Under the new three-year medium-term business plan, we will expand our focus particularly on key areas such as molded parts for automobiles (TR), the medical market (DH), food packaging (DH), especially in ASEAN, and telecommunications/mobility/robotics/FA (EL).

Across its three business segments—compounds, films, and food packaging—we are also engaged in diverse fields across various market segments in regions such as ASEAN, North America, and China, as well as Japan. The products in the key areas of each market segment share basic production facilities within our respective business segments. We intend to optimize our portfolio and achieve growth and expansion by continuing to pursue optimal marketing targets in each segment.

Note:

TR = Transportation segment

DH = Daily Life & Healthcare segment

EL = Electronics segment

BC = Building & Construction segment

Sustainability

In the previous three-year medium-term business plan, we set “Contribute to Solving Environmental and Social Issues” as our . In the new three-year medium-term business plan, we will treat this as a major pillar alongside each of the “Earning Power” strategies, and will work on environmental initiatives, including decarbonization, as well as enhancing governance and risk management. We view these initiatives in particular as issues of perpetuity, related to our medium- to long-term corporate existence, and recognizing that they will help reduce the cost of equity, we will pursue them steadily.

Financial strategies

In Our new three-year medium-term business plan, we will work on reforms aimed at a “value-creating balance sheet.” We will implement structural reforms to the balance sheet, such as reducing cash and deposits and improving the cash conversion cycle. We also plan to reduce our holdings of investment securities after verifying the significance of holding them.

Using the cash generated from these efforts in addition to the three years of operating cash flow, we will work on growth/strategic investments, shareholder returns, and other initiatives.

Stakeholder communication

To ensure that Stakeholders understand the above initiatives in the new three-year medium-term business plan, we intend to strengthen our external communications, including IR and SR activities. We will also work to expand the base of shareholders who are willing to invest in us.

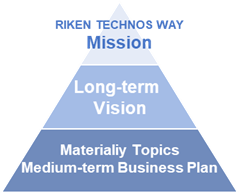

4. Long-term Vision

In conjunction with formulating the new three-year medium-term business plan, we will revise our long-term vision.

While continuing to pursue our existing long-term vision of “aiming to become the leading provider of comfort for all living spaces,” we have established the following three points as our “ideal image” for ten years’ time.

Aiming to become the leading provider of comfort for all living spaces

- Realize “monozukuri” and “value creation” with new ideas and approaches

- Contribute to a sustainable society, flexibly adapting to changes in society and the environment

- Ensure employees each have “job satisfaction” and “pride,” and “grow” together

This three-point “ideal image” was established after about a year of discussion among the Company’s officers, general managers, section managers, and chiefs, from the perspectives of “for the market/customers,” “for society,” and “for employees.”

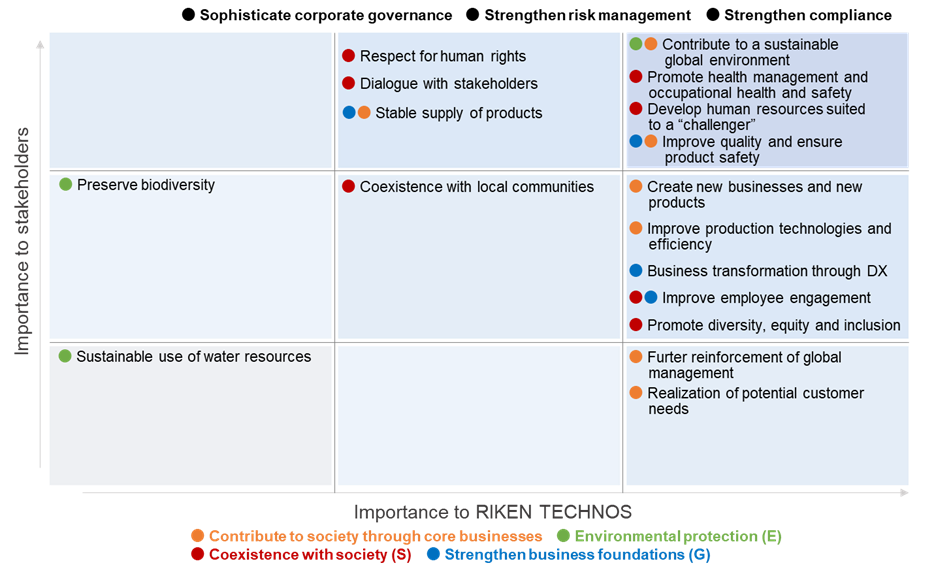

5. Materiality Topics

Following revision of our long-term vision, we also revised our materiality topics.

Reflecting the newly added “ideal image” in the long-term vision, we have added “improvement of employee engagement,” and have also reorganized the positioning of several items.

Details of the new three-year medium-term business plan, long-term vision, and materiality topics will be explained at the Financial and Management Results Briefing for Fiscal Year Ended March 2025, which is scheduled for May 20, 2025.

The RIKEN TECHNOS GROUP will strive to create value under the new three-year medium-term business plan “One Vision, New Stage 2027” and the long-term vision, and continue to take on challenges to achieve further advancement.